A Conception To Possess Social Safety

Some difficult questions defy tardily answers. What is the pregnant of life? What happens correct at the lawsuit horizon of a dark hole? How tin move the the U.S. substantially cut wellness attention spending? But for other questions, the answers are fairly clear, as well as what is lacking is a willingness to choose. Fixing Social Security falls into this category. As I have got argued from time to time inwards the past, the actuaries at Social Security regularly release a listing of possible revenue enhancement increases as well as create goodness cuts, as well as its non difficult to lay together a packet that fixes Social Security. I sometimes say that if nosotros locked a grouping of 100 randomly chosen people inwards a room, as well as said they couldn't exit until they had a two-thirds bulk for a innovation to railroad train Social Security, they could endure out inwards fourth dimension for lunch.

"With reserves that accumulated inwards previous years to supplement annual payroll taxes, Social Security tin move encompass all of the benefits that workers claim through 2034. After that, the reserves volition endure used upwardly as well as projected revenues volition solely encompass nearly three-quarters of the benefits to which workers are legally entitled. Some combination of higher payroll taxes, lower benefits as well as novel revenue sources volition endure needed to residue the books."

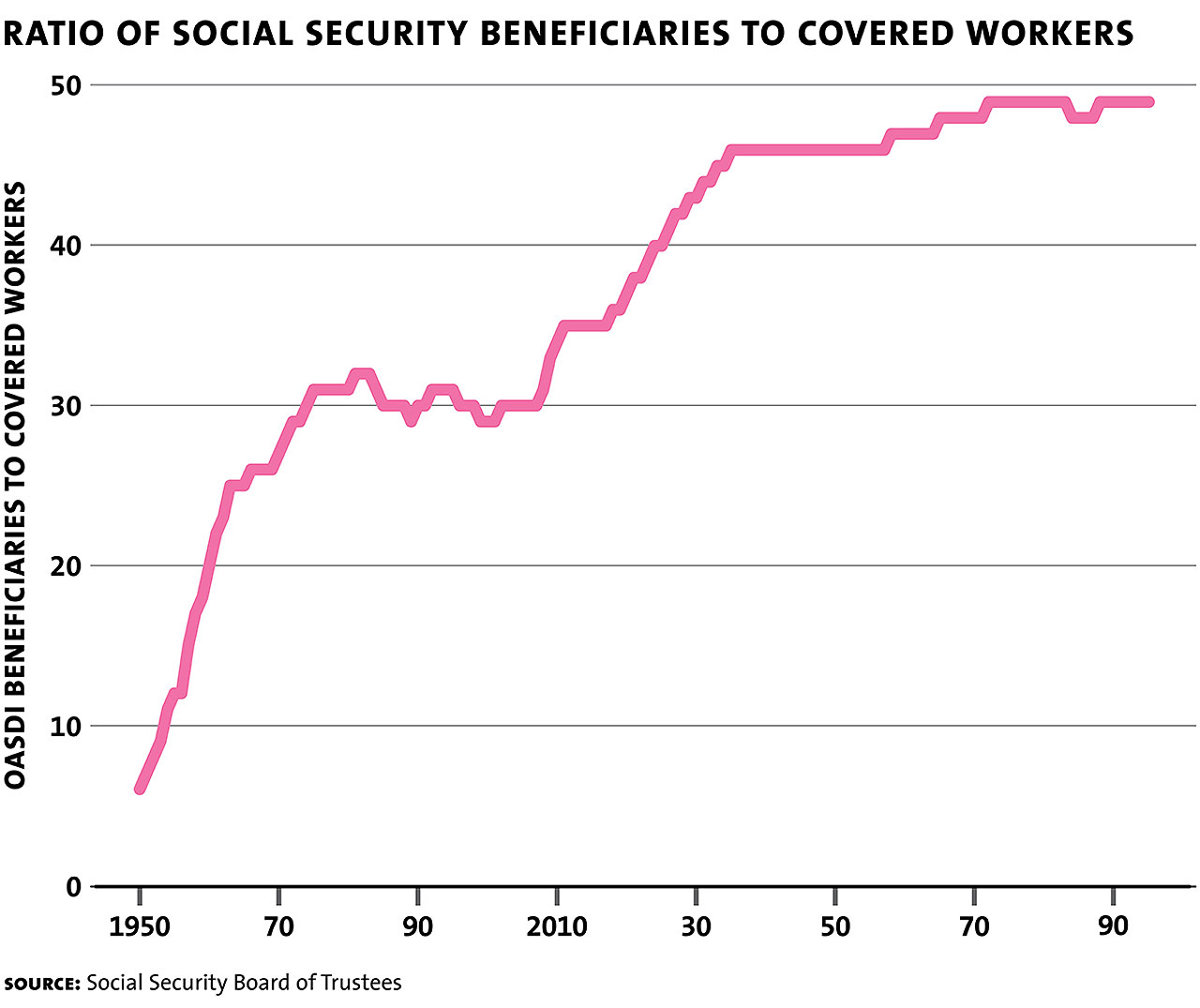

Influenza A virus subtype H5N1 pair of figures may assist to illustrate the underlying problem. The front end halt of the "baby boom" generation, born from 1946 upwardly through the early on 1960s, started hitting retirement historic menstruum inwards 2010. Life expectancies are up. From nearly 1970 to 2010, at that spot were nearly 30% every bit many beneficiaries every bit workers contributing to the system; but past times 2030, at that spot volition endure 45% every bit many beneficiaries every bit workers. To lay it some other way, the ratio of payroll revenue enhancement contributors to beneficiaries was nearly 3:1, as well as it's heading for closed to 2:1.

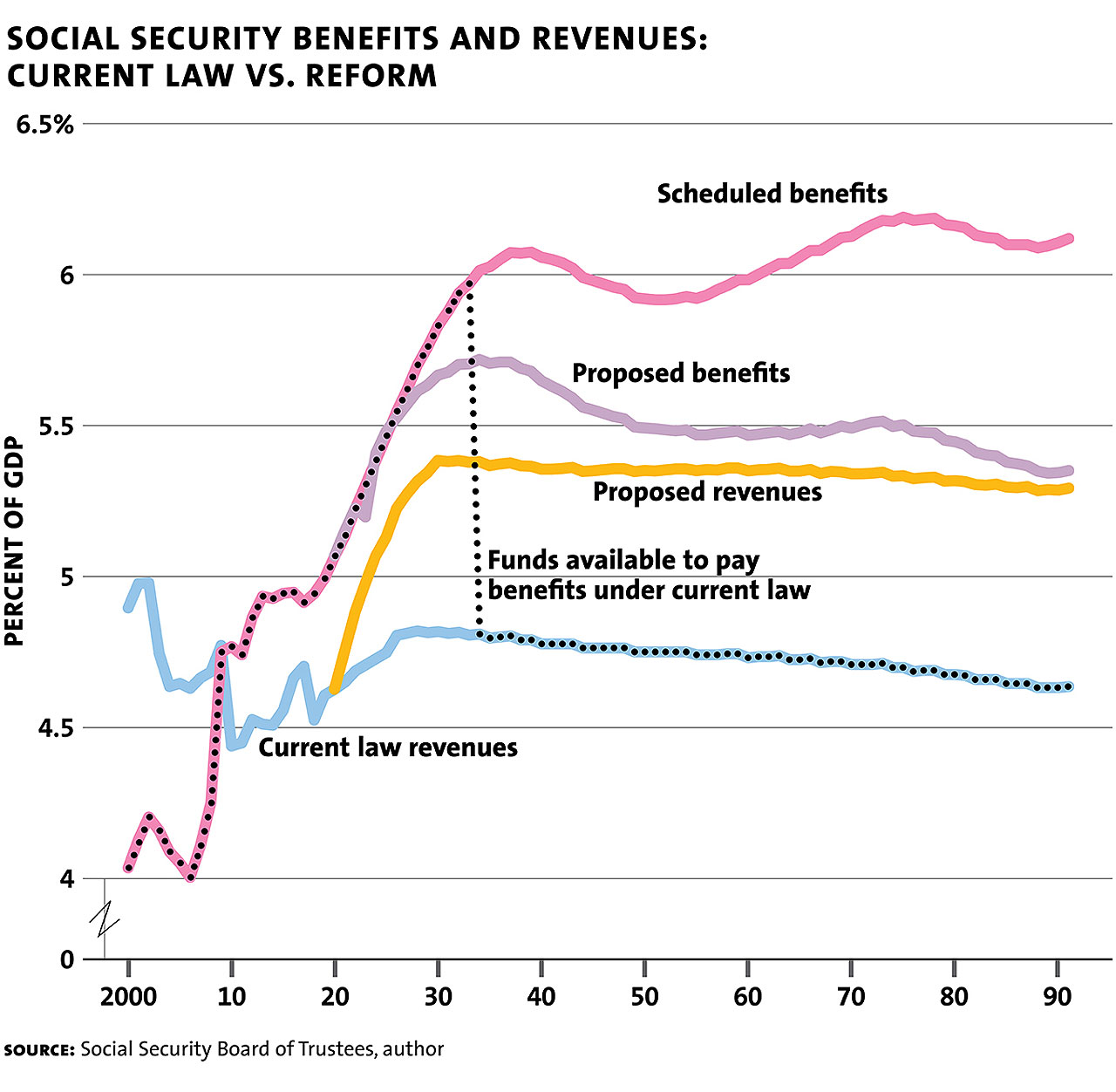

Looking at the path of spending as well as revenues inwards Social Security shows the result. Back inwards 2000, revenues into the organization exceeded outflows, which is the menstruum when the trust fund is beingness built up. But dorsum or thus 2010, the lines cross, thus outflows travel past times revenues as well as the trust fund is beingness depleted. In 2034, every bit shown past times the vertical dashed line, the trust fund runs out. The figures shows scheduled benefits as well as revenues, as well as it likewise shows Gale's proposed innovation for getting them to meet.

I should banker's bill that Gale's innovation is, every bit he notes, truly from a study past times the Bipartisan Policy Center, Securing Our Financial Future: Report of the Commission on Retirement Security as well as Personal Savings, published inwards June 2016. The 5 primary ingredients include:

Raise the Payroll Tax Cap

In 1977, the payroll revenue enhancement cap was laid at ninety percent of payoff inwards the economic scheme as well as was indexed to grow inwards tandem amongst average wages. Since then, however, average payoff have got grown solely modestly piece the payoff of high-earners have got charged ahead. Consequently, past times 2016, Social Security taxes covered solely 83 percent of total wages. Under the commission’s proposal, the taxable net turn a profit cap would endure raised to encompass 86 percent of payoff past times the halt of 2024. Thereafter, the cap would endure indexed to the growth inwards average wages, addition one-half a percent betoken annually. ...

Tax More of the Benefits of High-Income Households

Currently, people amongst incomes higher upwardly $25,000 if unmarried ($32,000 if married) owe income taxes on a portion of their Social Security benefits, amongst the taxable part peaking at 85 percent. The committee proposes to revenue enhancement high-income households (singles amongst income higher upwardly $250,000 as well as married couples amongst income higher upwardly $500,000) on 100 percent of their benefits. ...

Raise the Payroll Tax Rate

The committee would elevator the payroll revenue enhancement charge per unit of measurement past times 0.1 percent points each twelvemonth for the side past times side decade, peaking at 13.4 percent. That is, employees as well as employers would each eventually pay 6.7 percent of payoff below the taxable cap, upwardly from 6.2 percent today. ...

Raise the Full Retirement Age

The packet would increment the total retirement historic menstruum past times 1 calendar month every ii years starting inwards 2027, until it reaches 69. The rationale is simple: people are living longer. For example, 20-year-olds inwards 2014 were expected to alive to historic menstruum 80, piece 20-year-olds inwards 1950 were expected to alive to simply historic menstruum 71. ,,, [A]s nosotros enhance the total retirement age, nosotros should non enhance the historic menstruum (now 62) at which retirees tin move laid about receiving early on benefits. Increasing the early on retirement historic menstruum would disproportionally wound those who notice it specially difficult to travel past times historic menstruum 62 — notably, manual laborers amongst little fry age-related disabilities.

Protect Low-Income Beneficiaries as well as Make Benefits More Progressive

Because low-income workers would sense create goodness cuts resulting from a higher retirement age, the commission’s reforms include several provisions to offset the impact. First, it would brand the annual create goodness formula to a greater extent than progressive ... Second, it would enhance minimum benefits. Influenza A virus subtype H5N1 unmarried mortal amongst a monthly create goodness of $500 today would larn an increment to $784. The boost would pass upwardly every bit benefits rise, as well as it would disappear in 1 lawsuit benefits for a unmarried retiree reached nearly $900 per calendar month ($1,360 for couples).For some years, I've thought that fixing Social Security offers the possibility of a large political win for the political party that is willing to have got the chore seriously. The plan is real popular, as well as provides income to nearly sixty 1000000 by as well as large elderly as well as disabled Americans. Democrats could have got proposed a serious innovation inwards the fourth dimension window of 2009-2010, when they controlled Congress, as well as Republicans could have got proposed a serious innovation from 2016-2018, when they controlled Congress. Surely, beingness the political party that saved Social Security would endure worth some political points?

Perhaps what needs to endure defended hither is the basic construction of Social Security: that is, a retirement innovation that has some linkage from wage contributions to benefits as well as that offers an inflation-adjusted lifetime current of payments. The plan was intended from the showtime every bit a basic edifice block for retirement, amongst the thought that people would have got other forms of retirement savings. But a sure number of Republicans desire to plough the plan into a private-sector retirement scheme, where people invest their ain funds every bit they please. Meanwhile, a sure number of Democrats desire to brand the plan much to a greater extent than redistributive from those amongst high incomes to those amongst lower incomes, which would hateful a higher grade of separation betwixt what is paid into the plan as well as what is received.

But trying to transform Social Security into something else, thus that its baseline business office is diminished inwards pursuit of other goals, is sure enough complex, as well as in all probability misguided. In comparison, fixing Social Security every bit it stands is fairly straightforward. If y'all aren't wild nearly elements of the Bipartisan Policy Commission suggestions, the specifics tin move sure enough endure tweaked. But the kinds of proposals described hither have got the bully reward that they don't rely on waving whatever magic wands. They don't claim that Social Security tin move endure fixed past times eliminating waste, fraud, as well as abuse, or past times an unexpected surge of economical or stock marketplace growth. The proposals simply expression upwardly the tradeoffs squarely, as well as suggest 1 agency to proceed.

0 Response to "A Conception To Possess Social Safety"

Post a Comment